Category: Tax

-

Logic Does Not Apply

A month ago, I have just completed my tax submission. There is something not right about our tax system. It seems that it is not working for lower income group and it doesn’t benefit them. Why do I say that?

Take for example: We get books rebates up to 1000.

If you are earning 2500 a year, basically the rebates don’t apply to you because you are not subjected to tax. You get no benefit from the book rebates.

If you are earning higher and after all the deduction, the taxable income is 10K. You are entitled to a 3% discount or rebate on books up to 1000 you spend.

If you are earning higher and after all the deduction, the taxable income is 70K. You are entitled to 24% discount or rebate on books up to 1000 you spend.

More than 250K, you get a 28% discount.

If you see the trend above, it means the more you earn, the more discount you get. Therefore the richer you are, the more money you save.

You then argue, hey I pay more % tax if I earn more. Regardless of the book rebates, you still pay the same %. You cannot say because I pay more tax, I should have more discount with books. Not right at all. My point is that the book rebates is not equal for every body.

It should be made that lower income earners should benefit more from it versus higher income earners. This is not the case. Someone ought to rethink of a better method. Don’t you think so?

-

13 Days To Pay Up

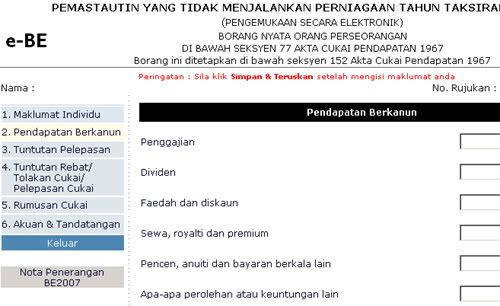

April is the month of tax for most employed folks in Malaysia. How many of you are still submitting paper form?

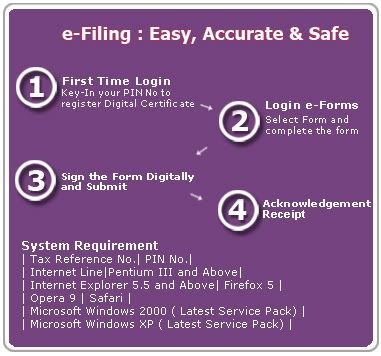

Shame on you!Try to submit through online, it is easy, fast and paperless. Opps, it is not exactly paperless because you still have to print a copy for record. You do not have to use liquid paper or worry is the entry right justify or left justify.It is a simple 4 steps process:

Info on some of the Rebates:

Individual – RM8000

Medical for parents – RM5000

Education Fees for listed courses – RM5000 (IT courses applied)

Books/Magazine/Journals – RM1000

Computer – RM3000

Children below 18 – RM1000 per child

Life Insurance and KWSP – RM6000

Medical and Education Insurance – RM3000By the way, do NOT cheat tax by putting RM1000 for books if you do not have any purchased receipts. It is a matter of time before the IRB audit you. If you cannot produce the receipts you will be fined.

Another tip is that if you cannot afford to pay the full amount of tax, you can always visit the tax office to request to pay by installment. You can also request them to issue a letter to your company to have deduction from your future salary.

Remember you have to submit the form and pay the tax before 30th April to avoid fine. Have a good tax month. Next month I think I can just eat roti and drink water only.

More Info on Malaysia Tax on http://www.hasil.org.my/english/eng_index.asp